25+ retiring with a mortgage

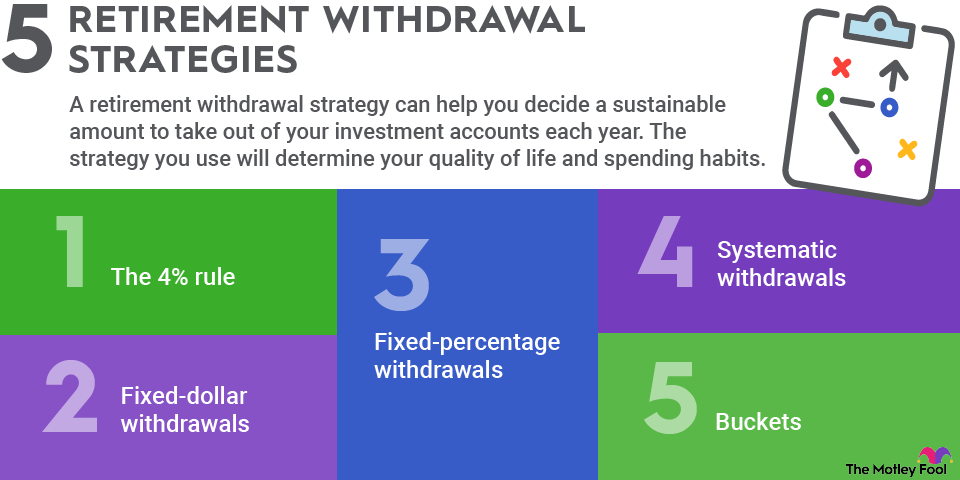

Web If your plan is to rely on withdrawals from traditional 401k and IRA accounts to pay the mortgage at age 70-plus keep in mind that all withdrawals will be as income. While the goal for many retirees is to minimize the amount of debt they have during.

Bet Your Retirement Income On The Usa Seeking Alpha

Of course paying off your mortgage early might not be right for everyone.

:max_bytes(150000):strip_icc()/GettyImages-1457475433-f31158bd109549edb34039295146e199.jpg)

. Web Retiring with a mortgage is a big financial decision -- youll want to make the right choice. Web Assume that your mortgage has an outstanding balance of 100000 dollars. Web The average interest rate on a 30-year mortgage is just above 3 while for a 15-year fixed-rate mortgage its about 27 according to NerdWallet.

If youre a baby boomer chances are you bought your first house in your late 20s or early 30s. Web In 2016 46 of homeowners aged 65-79 had mortgage debt with a median balance of 77000 according to a Harvard University study. The after-tax return on a 5.

Web 2 days agoAiden has roughly a 250000 net worth which is pretty good for a 25-year-old Mr. That means your effective mortgage interest rate is 3 percent. But what if you cant.

Web This new type of reverse mortgage would help retirees generate much more income Last Updated. If you make more money keeping it invested. The average 30-year fixed-mortgage rate is 694 the average rate for a 15-year fixed mortgage is 619 percent and the average rate on a 51 ARM is 585 percent.

Web Your return from paying off your mortgage before retirement is lower if youre still getting the full tax deduction for your mortgage interest. The average 30-year fixed-refinance rate is 693 percent down 19 basis points compared with a week ago. Downsizing your current home.

Web The net cost of a mortgage with a 3 rate is 228 for taxpayers in a 24 tax bracket who itemize their deductions. Say your marginal tax bracket in retirement will be 25 percent. Get instant access to discounts programs services and the information you need to benefit every area of your life.

Depending on your current financial. Web About 30 of TIAA clients in retirement or within one year of retirement continue to maintain a mortgage. Retiring with a mortgage can make managing your finances more difficult but it doesnt have to be an outsize burden if you know what factors to consider.

Downsizing may allow you. Web Carrying a mortgage into retirement allows individuals to tap into an additional stream of income by reinvesting the equity from a home. Web Rates continue to rise.

Web How to qualify for retirement mortgages. For example consider a 900000 home located in a gated community with HOA fees of 100 per. Though qualifying for a mortgage with retirement income comes with specific requirements.

Lowering your overall debt early will give you less to worry about when you retire. March 20 2021 at 1040 am. Empty-nesters tend to be good candidates for a move to a smaller home.

This is using the 4 withdrawal rate that many advisors consider safe. With rates low and inventory in many markets. Good Luck Getting a Mortgage Even If Youre Wealthy.

Web Current 30 year mortgage refinance rate dips --019. That could require withdrawing 1800 or more to cover the tax bill and leave you enough for the payment. Put the money you were spending on your mortgage into retirement savings they say.

A retirement nest egg of 25 million can likely produce an annual income of 100000 for as long as you are likely to live. March 19 2021 at 1128 am. Key points If you purchased a home late in life or refinanced often you may still have a.

The other benefit is that mortgage interest is. The cost remains 3 for those who do not itemize. Prepare for more paperwork and hoops to jump through than you could imagine.

Retirement Income From 25 Million. A month ago the average rate on a. Web Retiring your mortgage early can save you money in interest payments.

Lets say your monthly mortgage is 1500. Web AARP Membership -Join AARP for just 12 for your first year when you enroll in automatic renewal Join today and save 25 off the standard annual rate. Similar to getting a mortgage before retirement youll need to have reliable income now and the foreseeable future that shows you can repay the mortgage you must have good credit and have little debt.

Web May 25 2021 How to retire with a mortgage By Anne Levy-Ward Pay off your mortgage before you retire they say. Web The good news. One 70-year-olds story highlights the challenges.

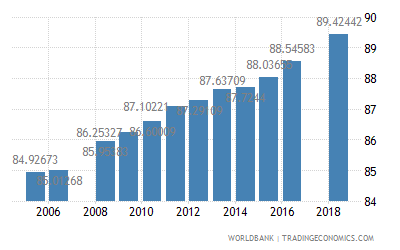

This is a 76 increase in just 18 years. Applying for a mortgage during retirement is the same as applying for a mortgage while employed. Granted nearly half of that has come from home price appreciation on the house he purchased in.

When paying off a mortgage early might not work. Web He also pointed out that if youre paying say 25 on your mortgage and you pay it off you essentially just earned that rate on the money you used to retire the loan. Web For answers to your retirement questions talk to a financial advisor.

Web To qualify for a mortgage after retirement make sure your PITI is less than 28 of your total income. From 2007 to 2010 there was a 200 increase. You need to meet the same basic credit and down payment requirements and document your income based on the type of retirement income s you receive.

If you currently own a home you may want to sell it to move into something smaller and more manageable. If your agreed-upon prepayment penalty is 2 and you pay it all in year one you would be assessed a penalty of 2000. Back in 1989 just a little over a quarter of all households 264 were living as retired with a mortgage By 2007 nearly half 465 of all households could be classified in the same manner.

Downsizing can also be a practical choice if youre struggling to meet your retirement savings goal and your mortgage is more than 25 to 30 of your income said Piershale. Web The observations we can make based on this research include. It would be a.

Downsize your living arrangement. Web Retirees have plenty of options all with their own pros and cons. Dont pay off your mortgage.

8 Best Strategies For Retirement The Motley Fool

More Retirees Today Have A Mortgage Squared Away Blog

10 Questions Every Couple Should Ask Before Retiring Parade Entertainment Recipes Health Life Holidays

Is Rs 1 Crore Enough To Retire In India 2023 Stable Investor

How To Save For Retirement And Retire Early As A Couple

How Much Money Should I Have Saved By 25 The Motley Fool

How We Paid Off Our Mortgage More Than A Decade Early

Why You Need A Retirement Plan A B And C

Maynard Paton The Fire Leap My Story To Becoming Mortgage Free And Retiring Early

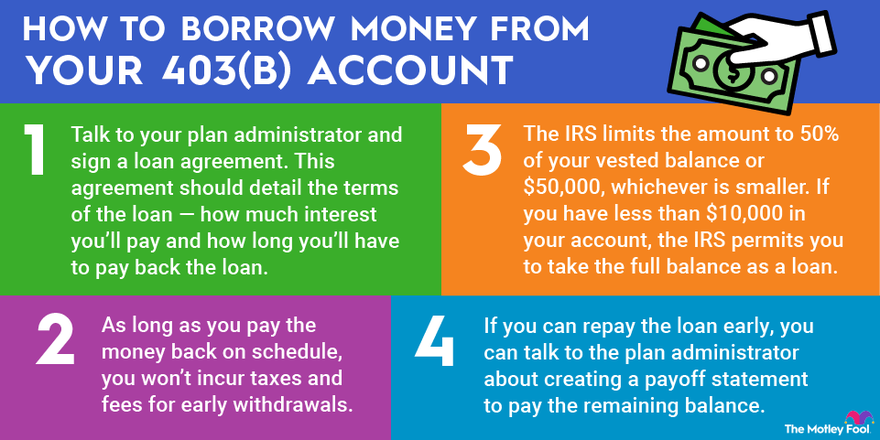

How 403 B Loans Work The Motley Fool

Should You Pay Off Your Mortgage In Retirement Experts Weigh In

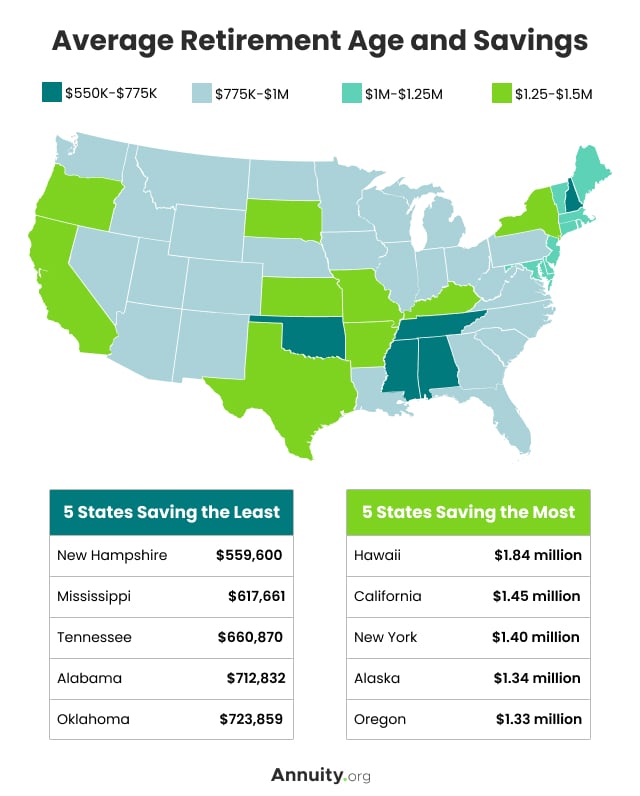

50 Essential Retirement Statistics For 2023 Demographics Savings

Refinancing Loans Logix Smarter Banking

What S Happening In The World Economy The Rush To Retire Bloomberg

United States Percentage Of Population Age 25 With At Least Completed Upper Secondary Education Isced 3 Or Higher Male 2023 Data 2024 Forecast 1970 2018 Historical

Denver Mortgage Lender Mortgage Company Offering Colorado Home Loans Us Mortgages

5 Retirement Withdrawal Strategies The Motley Fool